Interested in reducing your Tax Bill?

Making contributions to a pension plan could be the answer to reducing your tax bill.

Did you know that you can make a contribution to a pension plan before the 31st October each year and claim tax relief for the previous year?

October 31st (or 12th November 2019 if you use the Revenue Online Services (ROS) to pay your tax bill) is the final date on which you can claim tax relief on backdated pension contributions, in other words, this is the last chance to get some money back from the tax man for 2018!

If you are a PAYE employee and you pay a lump sum Additional Voluntary Contribution (AVC) by cheque/Direct Debit and claim tax relief on this AVC by 31st October you can get tax relief in respect of the previous calendar year.

For example, if you pay a lump sum AVC by 31st October 2019 you may get tax relief in respect of any unused tax relief for 2018 providing you claim this relief from the Revenue by the October 31st 2019.

Example

- Additional Voluntary Contribution paid 25 October 2019: €2,000

- Reduction in 2018 tax bill (40% tax payer): € 800

- Actual cost to you of additional €2,000 into your pension: €1,200

Self-employed people can also claim back some tax: Let’s say you have a bill of €10,000 for 2018 and preliminary tax of €10,000 for 2019 to pay by 31st October 2019. You could pay Revenue the €20,000 and this job is done for another year or you could make a payment of €5,000 to your pension. This will have the effect of reducing last year’s tax bill by 40% of that €5,000 (i.e. €2000). As preliminary tax for 2019 is 100% of last year’s bill, you also reduce the preliminary tax by the same amount (i.e. €2,000).

So, you could pay Revenue €20,000 or you could put €5,000 in your pension and pay Revenue €16,000 (i.e. €20,000 – €2,000 – €2,000). Your total spend is only €1,000 more but for that extra €1,000, you pay Revenue the amount due and also have €5,000 in your pension fund – it’s a win win situation!

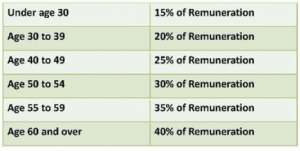

The table opposite shows the percentage of your income that you can get tax relief on when contributing to a pension plan, depending on your age and subject to a current maximum annual earnings amount of €115,000p.a.

Remember Saving for your retirement is still incredibly tax efficient.

As well as tax relief, the funds in which your contributions are invested currently benefit from tax-free growth, unlike most saving methods which may be liable for DIRT Tax or Capital Gains Tax. This means pension funds benefit from being able to reinvest the non-taxed returns to generate higher future returns and should build up quicker than a fund that has to pay tax on its investment returns.

Also, when you retire you can take part of your pension fund as a tax-free lump sum. The amount you can take depends on the type of pension plan you have in place. It is important to remember that your regular pension income or Approved Retirement Fund ARF may be subject to tax.

For more information please contact CPAS at 01 407 1400 or email info@cpas.ie